By Vaidik Trivedi

News Editor

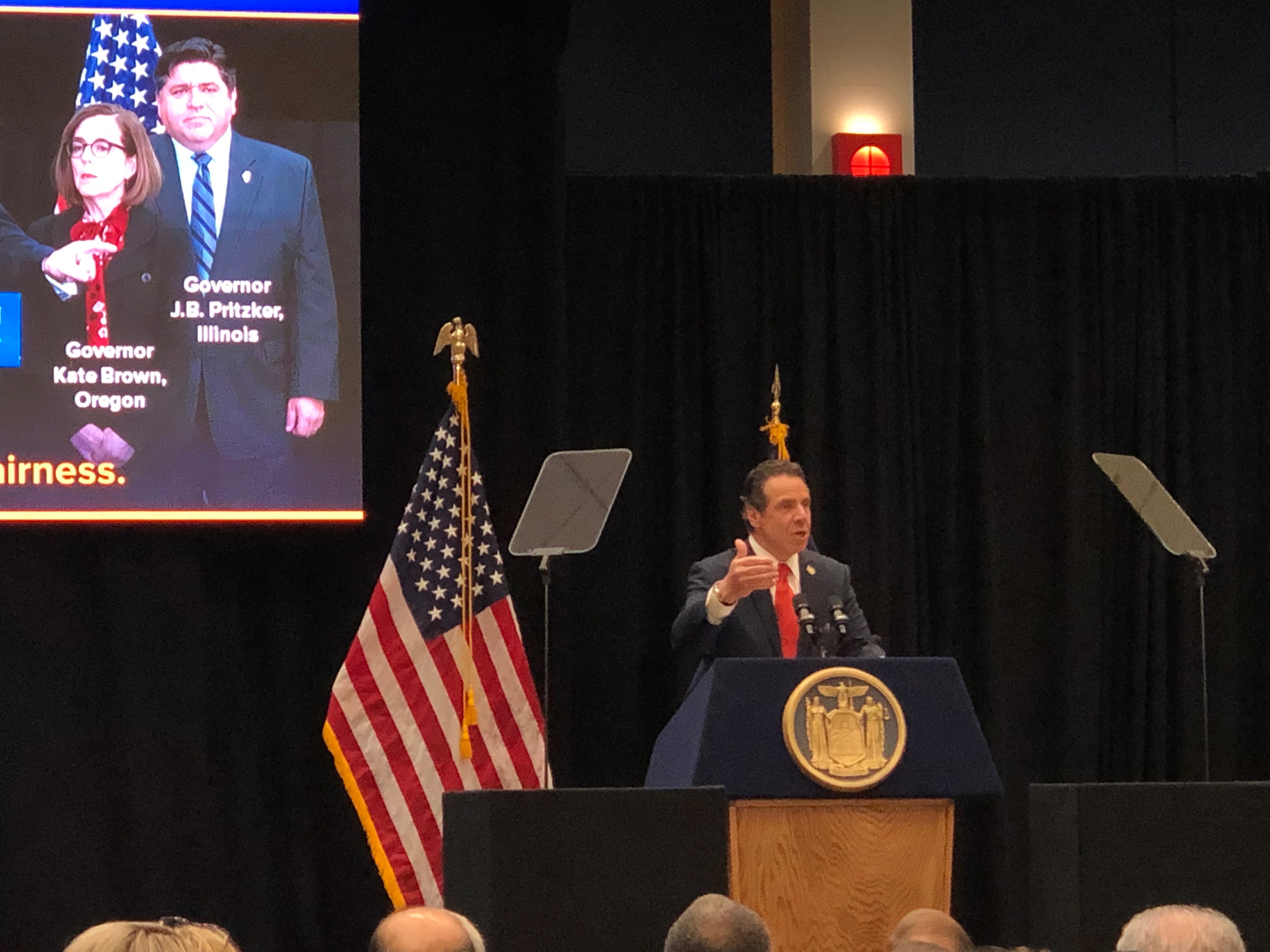

Stony Brook University hosted New York State Governor Andrew Cuomo to discuss the hefty $175 billion New York fiscal budget for 2019-20 on April 11 in the Student Activity Center.

Cuomo said that the recently passed state budget will have $18.6 billion allocated for development across Long Island. The budget aims to revamp the Long Island Railroad for faster connectivity to Manhattan along with starting new programs across Long Island to battle climate change.

“Big problems require big solutions,” Cuomo said.

The LIRR will receive nearly $6.6 billion to build new tracks and improve existing ones. The state is also planning on buying 202 new train cars which will cost around $734 million, along with investing $2.6 billion in a 40-year-old plan called the East Side Access Project, which will connect Long Island to Grand Central Station.

A new AirTrain to LaGuardia Airport is also under way to make commuting easier for Long Islanders. With the new AirTrain in place, Long Islanders can go to LaGuardia without leaving Long Island, unlike before.

“When you put these projects together, it’s going to be a different commuting experience for Long Island,” Cuomo said.

Cuomo claimed that New York State is facing one of the hardest times, with political polarization rising, pushing Amazon HQ — a potential tremendous economic boost — out of state. Temperatures on both sides of the political aisle are rising with the reducing scope of compromise.

“The state of New York is under attack from Washington D.C.,” Cuomo said.

Criticizing the federal taxes levied upon New Yorkers, Cuomo asked New Yorkers to unite against unjust taxation methods of the federal government that make living in New York so expensive.

“The SALT deductions will cost Long Island $2.2 billion every year,” Cuomo said. “Trump is trying to tax you on the tax that you already paid to the state.”

The state of New York has one the highest property taxes across the country. Average property tax rate in New York is $4,000, while the national average is $3,000. In the past two decades, property taxes grew double compared to the growth of the average income in the state.

“You can continue to raise taxes in an amount that is more than what people are earning,” Cuomo said. “It doesn’t make sense mathematically.”

Cuomo went ahead to call out the president on his hypocrisy. Redistribution of wealth is a hard “no” in Trump’s books but, according to Cuomo, it has been happening for decades.

“There are ten states that contribute money in the federal pot and the remaining 40 take more money from the federal government than they give,” Cuomo said.

The federal government is taking money from the “richer” states to provide funding to the poorer ones, Cuomo explained. New York is the highest donor in the federal tax pot, putting in $36 billion more every year than it receives from the federal government.

“With these SALT deductibles, we are putting in an additional $15 billion in the pot,” Cuomo said. “We are basically subsidizing other States’ taxes by paying more.”

This year, New York passed a permanent property tax rate capped at 2% to bring down skyrocketing tax rates. The 2% property tax cap is supposed to save nearly $8 billion in taxes, over the course of the next decade for New York tax payers.

“Around 1.1 million residents or nearly 70% of Long Islanders will receive tax cuts this year because of our budget, and we should be proud of that,” Cuomo said.

The budget includes $750 million dollars for economic regional development across Long Island.

Support for local government and county offices has also increased with additional funds of $26 million to serve Long Islanders better.

The new budget eliminated the internet tax advantage, which imposed taxes on online purchases. Now when you buy a product online, you will have to pay sales taxes.

Cuomo also promised to develop the forgotten downtown areas of Long Island that used to be a quintessential part of community and culture. The Downtown Revitalization Initiative will invest $10 million to renovate Long Island downtowns.

“Millenials want to be in downtown areas,” Cuomo said. “They like the history, they like the action, they don’t want to get in the car and drive everywhere and we have beautiful downtowns.”

The education sector of New York saw a huge influx of cash as well. Long Island education budget saw a 3.9 percent increase from last year’s budget, and prioritized poor school districts that needed more funding.

The eligibility cap for the New York State-funded Excelsior scholarship has also gone up from $90,000 to $125,000 for household income per year, making more students eligible for the scholarship and making higher education more accessible for New Yorkers. This will help 26,000 Long Islanders to pursue higher education by providing free tuition for all SUNY campuses.

Stony Brook University benefited from the new fiscal budget as well. SBU is supposed to receive $75 million for the construction of the 70,000-square-foot Institute for Discovery and Innovation in Medicine and Engineering.

Cuomo plans on commercializing the academic development of universities, which will bring in cash and reduce government spending on schools.

“We have the academic universities and we are going to make the bridge to the commercial market,” Cuomo said.

If academic universities are commercialized, it will increase the cost of attending universities because of decreased state funding, making it harder for students to afford college. Recently SBU announced it would raise its academic fee, which drew backlash from students.